Two-wheeler OEMs begin FY2016-17 on a peppy note, new models give sales charge

Hero MotoCorp, HMSI, India Yamaha and Royal Enfield record smart numbers for the first month of the new fiscal year.

Indian two-wheeler manufacturers have kicked off the new fiscal year on a sound note. The sales performance for April 2016, as reported by some of the top players, along with the forecast of above average monsoons, suggests that the market can hold on to growth for the first quarter of FY2016-17.

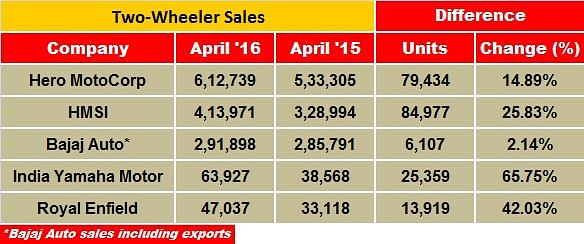

OEMs like Hero MotoCorp, Honda Motorcycle & Scooter India (HMSI), Bajaj Auto, Royal Enfield and India Yamaha Motor have reported year-on-year growth for the last month.

The largest two-wheeler manufacturer by volumes, Hero MotoCorp has reported double-digit growth – as it did in February and March 2016 – in its overall sales volumes for April including domestic and exports. The company sold 612,739 units (April 2015: 533,305) in April 2016, recording a healthy growth of 14.89 percent YoY.

An official release states that, “In addition to maintaining its leadership in the 100cc segment, Hero has also been further consolidating its leadership in the 125cc segment, driven particularly by the best-selling motorcycle Glamour, which grew by 23 percent in the last financial year (FY2016).”

The company has also garnered good response to its new scooter models – Maestro Edge and Duet. With one of the largest R&D facilities in the world that any two-wheeler manufacturer has, Hero MotoCorp is now working on a number of indigenous projects for Indian as well as global markets.

HMSI, the number two player in the domestic two-wheeler segment, has also reported a YoY growth of 26.52 percent in its overall sales for April 2016. The company has reported total sales of 431,011 units including exports of 17,040 units last month.

A split of domestic scooter and motorcycle sales conveys that HMSI registered sales of 263,320 units and 150,651 units of scooters and motorcycles respectively last month. It recorded a growth of 33.14 percent and 14.82 percent in its scooter and motorcycle portfolios respectively.

HMSI’s official sales release mentions that its domestic share now stands at 27 percent, gaining by one percent in April 2016. Further, the company has also added production capacity to accommodate the ever-increasing demand of its scooter models. It registered a sharp surge of 35 percent in the demand for its Activa brand of scooters during the last month. According to the company, it has sold more than 235,000 units of Activa models last month.

Bajaj Auto has clocked total sales of 291,898 motorcycles (including exports) in April 2016, marking a YoY growth of almost 2 percent. The flat growth can be attributed to the low export demand, thanks to the turmoil in the global oil prices that has affected its key markets such as Egypt, Nigeria and others.

However, the company continues to perform well on the domestic front. Interestingly, the domestic sales performance of Bajaj Auto bailed it out from reporting negative numbers for FY2015-16.

Reporting a substantial growth of almost 66 percent YoY for last month, India Yamaha Motor sold 63,927 units (including exports to Nepal) as against 38,568 units sold in April last year.

According to the company, the good growth can be attributed to increasing penetration and its expansion in Tier 2 and 3 cities along with its customer-centric activities. The Fascino scooter model and the 150cc FZ series motorcycles stand out as the largest-selling models for the company.

Commenting on his company’s growth in April 2016, Roy Kurian, vice-president – sales and marketing, Yamaha Motor India Sales, said: “As the Q1 (company follows calendar year) growth trajectory of 47 percent steadily heads into the current quarter with 66 percent growth in April 2016, Yamaha will continue its consolidated performance of steady sales growth along with more network expansion. The Fascino is doing extremely well and with the Cygnus Ray-ZR launched, Yamaha is looking to further augment its position in the scooter market by targeting a 10 percent market share by end of 2016. Yamaha’s introduction of the Saluto RX will sport more excitement as now it will cater to the requirements of basic commuter segment.”

According to a recent analysis of the scooter segment by Autocar Professional, Yamaha’s market share for FY2015-16 stood around 6 percent.

Meanwhile, continuing its dream run, Royal Enfield has registered total sales of 48,197 units for April 2016 including exports of 1,160 units. The company’s domestic sales stood at 47,037 units (April 2015: 33,118), which indicates YoY growth stands at 42 percent.

While the company commands a large loyal customer base in India, which continues to grow overtime, it is working on a number of new projects to enter into developed and mature motorcycle markets globally.

RELATED ARTICLES

Maruti's Kharkhoda Plant construction in full swing

Maruti Suzuki has proposed to spend more than Rs 7,000 crore for the construction and commissioning of this plant which ...

July 2024 From R&D incentives to EV infrastructure: What auto components industry expects from Budget 2024

July 2024 From R&D incentives to EV infrastructure: What auto components industry expects from Budget 2024

Vemuri Young Artist from India Recognized as one of the Winners at 16th Global Toyota Dream Car Art Contest

Vemuri Young Artist from India Recognized as one of the Winners at 16th Global Toyota Dream Car Art Contest

By Amit Panday

By Amit Panday

03 May 2016

03 May 2016

3719 Views

3719 Views