Profits for global car makers fell 11% in 2019 before Covid-19 took hold

Statistics from 28 brands show that operating profits plummeted before the coronavirus outbreak took hold.

Official data from 28 mainstream vehicle manufacturers shows that operating profits fell by 11% across the sector in 2019.

A report by Felipe Munoz from industry analyst firm Jato Dynamics shows that, despite a slight increase in revenue to 1.87 trillion euros (Rs 15,459,290 crore) across the board, operational profits dipped to 86.38 billion euros (Rs 714,103 crore) last year, down from 2018’s 96.71 billion euros (Rs 799,501 crore).

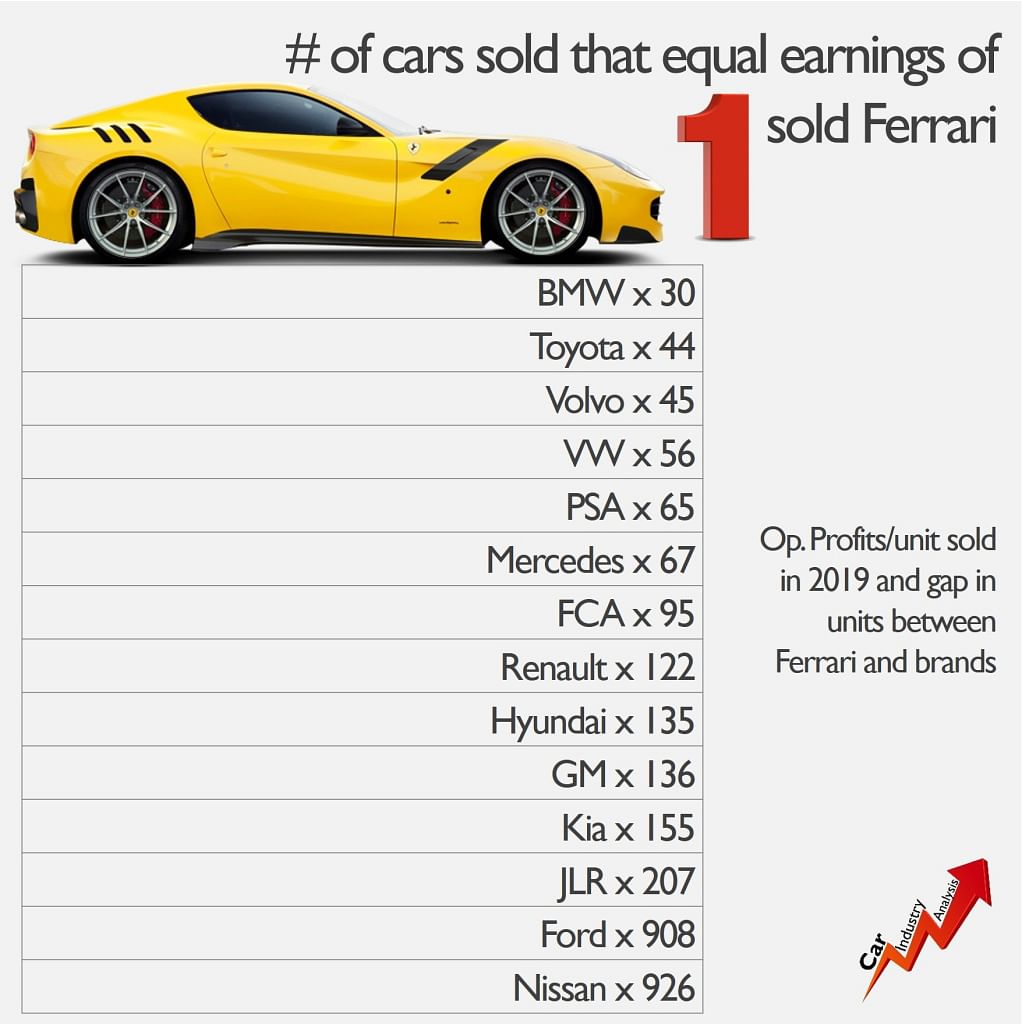

The report also reveals the massive differences in operating margins between brands. Ferrari recorded a 23.2% operating margin last year, with each of the 10,131 cars it sold making more than 86,000 euros (Rs 71 lakh)). For context, Munoz calculates that Ferrari makes as much profit from one car as BMW does from 50, Renault 122 and Nissan 926.

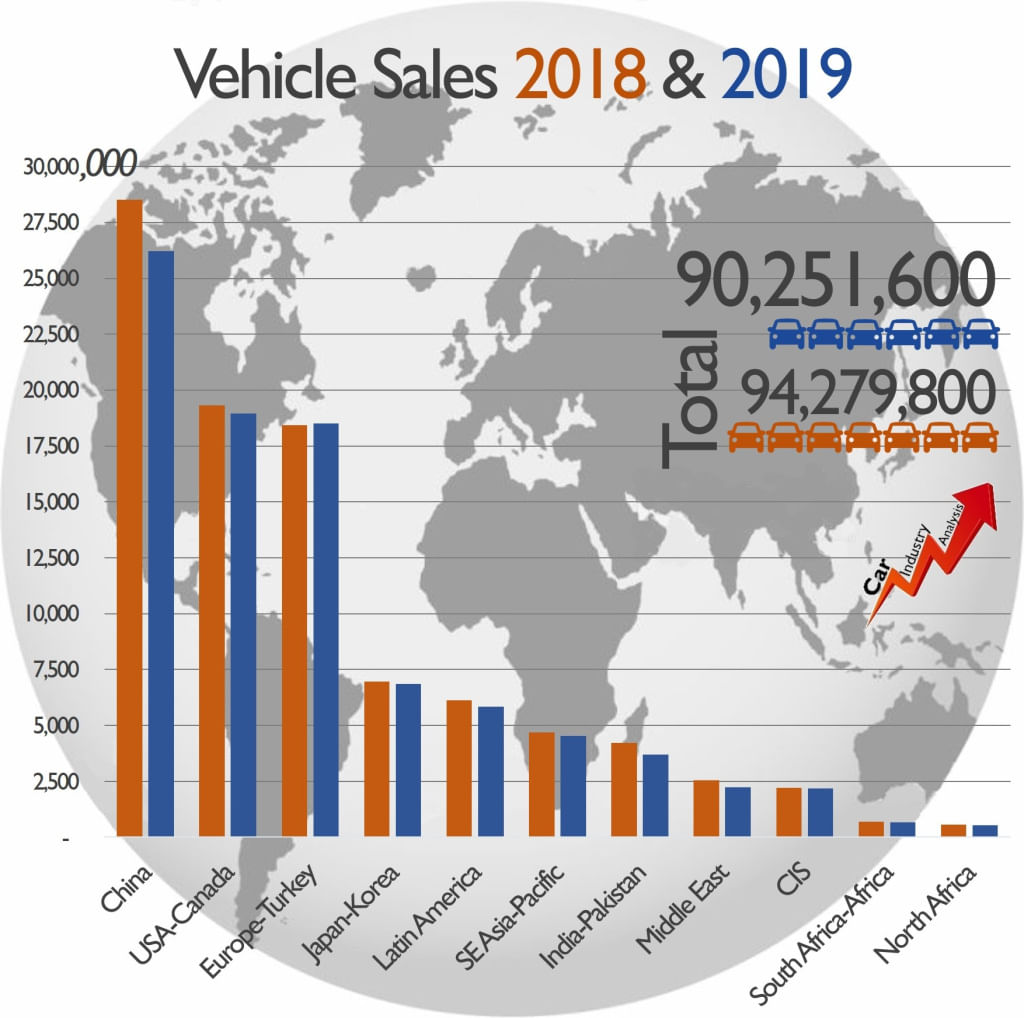

The overall profit drop is attributed primarily to legislative changes in China, which accounts for a significant 29% of worldwide vehicle sales, including the roll-out of stringent new ‘China VI’ emissions regulations and removal of government-backed financial incentives for electric vehicles.

Elsewhere, the US and European automotive markets began to show signs of stagnation after a long period of continued growth. Muñoz said, however: “Unlike China, the European and American car markets are mature ones, so this level of fluctuation can be considered within the normal range.”

Each manufacturer's situation varies, however, and Munoz told Autocar UK that Nissan in particular was impacted by a variety of factors in 2019, including an 8% drop in sales, heavy investment in electrification (which is less profitable than combustion) and internal issues stemming from its relationship with Renault.

The report also calls attention to the long-running US-China trade war, which has seen tariffs imposed on Chinese-built cars in America, and diminished demand for US-built cars in China. The two markets accounted for a combined 42% of global vehicle sales in 2019.

Uncertainty in key Asian and Middle Eastern markets, including India, Iran, Argentina and Turkey, was also a factor in the global slump. Some 5.1 million vehicles were sold in those four countries last year, down 21% from 2018.

Volkswagen No. 1 by volume

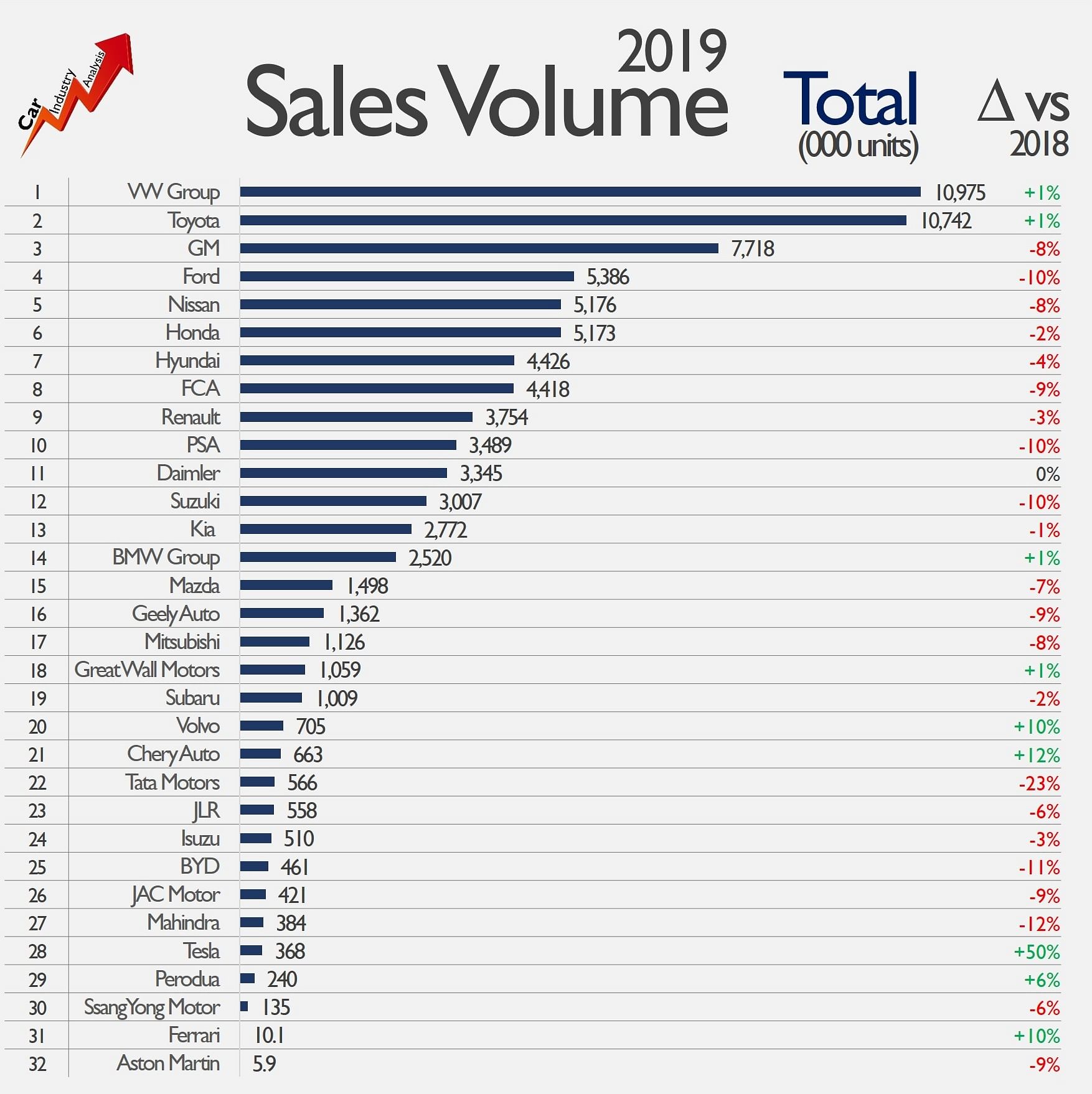

In terms of volume, the Volkswagen Group topped the charts in 2019, selling 10,975,000 units compared to Toyota’s 10,742,000. Both brands increased their sales by 1% year-on-year.

The next biggest manufacturer, General Motors, was some way behind with 7,718,000 sales, which was 8% short of its 2018 figures.

Tesla increased its sales 50% in 2019, selling 368,000 units worldwide - a result of the global rollout of the Model 3, its most affordable model yet. Tesla was also one of only two brands (including Ferrari) to post double-digit profit growth.

The report notes however, that although the US brand has ramped up production numbers, it’s still losing money because it’s in an expansion phase and investing heavily in its own growth. This means that it has actually lost 168 euros (Rs 14,000) on every car that left the factory.

Data charts: Jato Dynamics

Read more: Coronavirus and the Chinese car industry: what we can learn

RELATED ARTICLES

Sept 2024 From R&D incentives to EV infrastructure: What auto components industry expects from Budget 2024

Sept 2024 From R&D incentives to EV infrastructure: What auto components industry expects from Budget 2024

US car majors hit the brakes on driverless cars

Ford Motor and Volkswagen to close self-driving startup Argo AI, due to lack of technology and clear regulations.

Autoliv and Geely to develop advanced safety tech for future vehicles

Scope of cooperation includes safety for high-level autonomous driving, intelligent steering wheel technology, a 360deg ...

10 Apr 2020

10 Apr 2020

13017 Views

13017 Views

Autocar Pro News Desk

Autocar Pro News Desk