FY2016-17 opens to slowing India auto exports

While the passenger vehicle and commercial vehicle segments are in positive territory, de-growth in three-wheeler and two-wheeler exports has dragged down overall export numbers.

Indian OEMs recently surpassed China in passenger car exports in 2015-16 but the fact of the matter is that overall exports are slowing down.

Latest industry sales and export data, released by the Society of Indian Automobile Manufacturers (SIAM) yesterday, reveals that while the passenger vehicle and commercial vehicle segments are in positive territory, de-growth in three-wheeler and two-wheeler exports has dragged down overall export numbers.

In the April-May 2016 period, Indian automakers, across the passenger vehicle, CV, three- and two-wheeler segments, exported a total of 543,693 units, down 9.64% on April-May 2015 sales of 601,672 units.

Some OEMs export to Latin American and African markets, which have been adversely affected by the global slump in commodity prices and crude oil. The dollar crisis has resulted in much lower dollar inflows to these markets, thereby impacting their economies. Some of the badly affected markets are Egypt, Angola, Algeria, Nigeria and South Africa, which have been buyers of Indian-made motorcycles, among other vehicles.

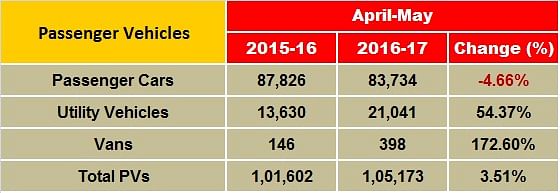

PV exports volumes up 3.51%

Of the total 105,173 passenger vehicles exported in the first two months of 2015-16, Ford India and VW India are the ones showing year-on-year growth. While Ford India shipped 21,438 units (+31.75%), the German carmaker despatched 14,684 units (+22.49%).

The big exporters – Hyundai Motors India (23,874/-14.64%), Maruti Suzuki India (19,297/-17.90%) and Nissan Motor India (13,101/-18.23%) – have all recorded declines.

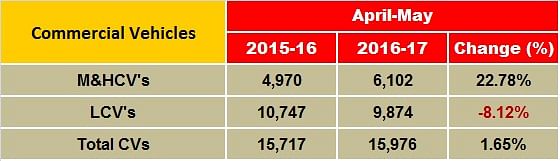

CV numbers plod

Overall commercial vehicle exports for April-May 2016 were 15,976 units, which is a 1.65% year-on-year growth. Tata Motors shipped a total of 7,646 units, down 6.96% while Mahindra & Mahindra, which is on an upswing, exported 4,898 units, up 4.01%. VECV Eicher is also seeing good export movement and the company exported 1,690 units (+148.53%).

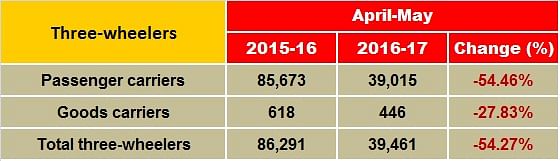

Three-wheelers badly hit

The three-wheeler sector has been badly hit by the slowdown in exports. Overall numbers for April-May 2016 are 39,461 units, down 54.27% year on year. All the key players have been impacted – Bajaj Auto (26,678/-56.75%), TVS Motor Co (7,807/-54.57%), Piaggio Vehicles (3,310/-24.65%) and Atul Auto (265/-40.72%).

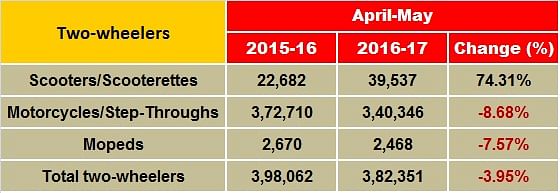

Two-wheelers feel the heat

The two-wheeler sector, like the three-wheeler industry, has also been adversely affected by the economic downturn in African markets. Its exports of 382,351 units in April-May 2016 are down 3.95% year on year.

While Bajaj Auto, India’s biggest two-wheeler exporter, shipped a total of 218,987 units (-14.60%), TVS Motor Co exported 56,092 units (-4.66%). Hero MotoCorp (27,476/+50.82%) and HMSI (37,508/47.17%) did well through as did Suzuki Motorcycle (12,483/+30.92%). Royal Enfield, which has made a foray into new export markets recently, despatched 12,483 bikes (+30.92%).

Find out whether India’s auto industry can live up to the AMP export target

RELATED ARTICLES

Resilient India Auto Inc’s production up 23% in H1 FY2023 to 1.36 million vehicles

With much-improved semiconductor supplies and market demand growing strongly, particularly for PVs and CVs, overall prod...

Maturing Indian car and bike market recalls 4.97 million vehicles since 2012

OEMs are voluntarily recalling their vehicles from the market to check and rectify possible defects. FY2022 saw 1.3 mill...

Analysis: How does China have more EV firms than it can count?

As the Chinese government suggests mergers are in order, here’s looking at who could thrive

10 Jun 2016

10 Jun 2016

35415 Views

35415 Views

Autocar Pro News Desk

Autocar Pro News Desk